Without an Accounting Manager’s ability to manage and communicate the health of the business, stakeholders cannot make well-informed decisions. In understanding these three concepts, it will help shape the foundation you need for that communication.

Having gotten to this point in your accounting career, I believe it’s safe to say you’re already familiar with the basics: Balance Sheets, Income Statements, Journals, etc.

But past the basics, there are concepts unique to Accounting Managers in the architecture, engineering, and environmental consulting (AEC) industry. Understanding and managing these concepts is an important part of effectively communicating your firm’s financial position to primary stakeholders – after all, that’s a large part of what you do.

So, by using my decade worth of experience in the AEC industry, I’ve created a list of the three major concepts Accounting Managers should understand when speaking to executives. Once you’ve read through this post, you can be confident that you’ll have the foundation you need to properly communicate the status of the business to your primary stakeholders.

Cash Management

First things first: your firm needs working capital to meet short-term obligations. But how do you know what your firm’s current working capital even looks like? By using the acid test ratio.

The acid test ratio shows your firm’s ability to successfully meet its short-term obligations. The goal of this test is to have current assets exceed current liabilities. This is critical: if your firm is unable to cover these short-term obligations in a timely manner, it can eventually lead to insolvency.

That’s why the old “cash is king” mantra isn’t going anywhere, because you need cash to keep your business up and running. And as an Accounting Manager – these are words you should live by. Day in, and day out, you need to ensure your firm is optimizing its cash resources. To help, I’ve identified two elements you can focus on to improve your firm’s cash flow:

- Proper management of your vendor payments

- Effective collection on your outstanding accounts receivable

The following sections of this post will discuss how to address these items.

Working Capital

The cash available for day to day operations.

Acid Test Ratio

Current Assets – Current Liabilities

Procure to Pay

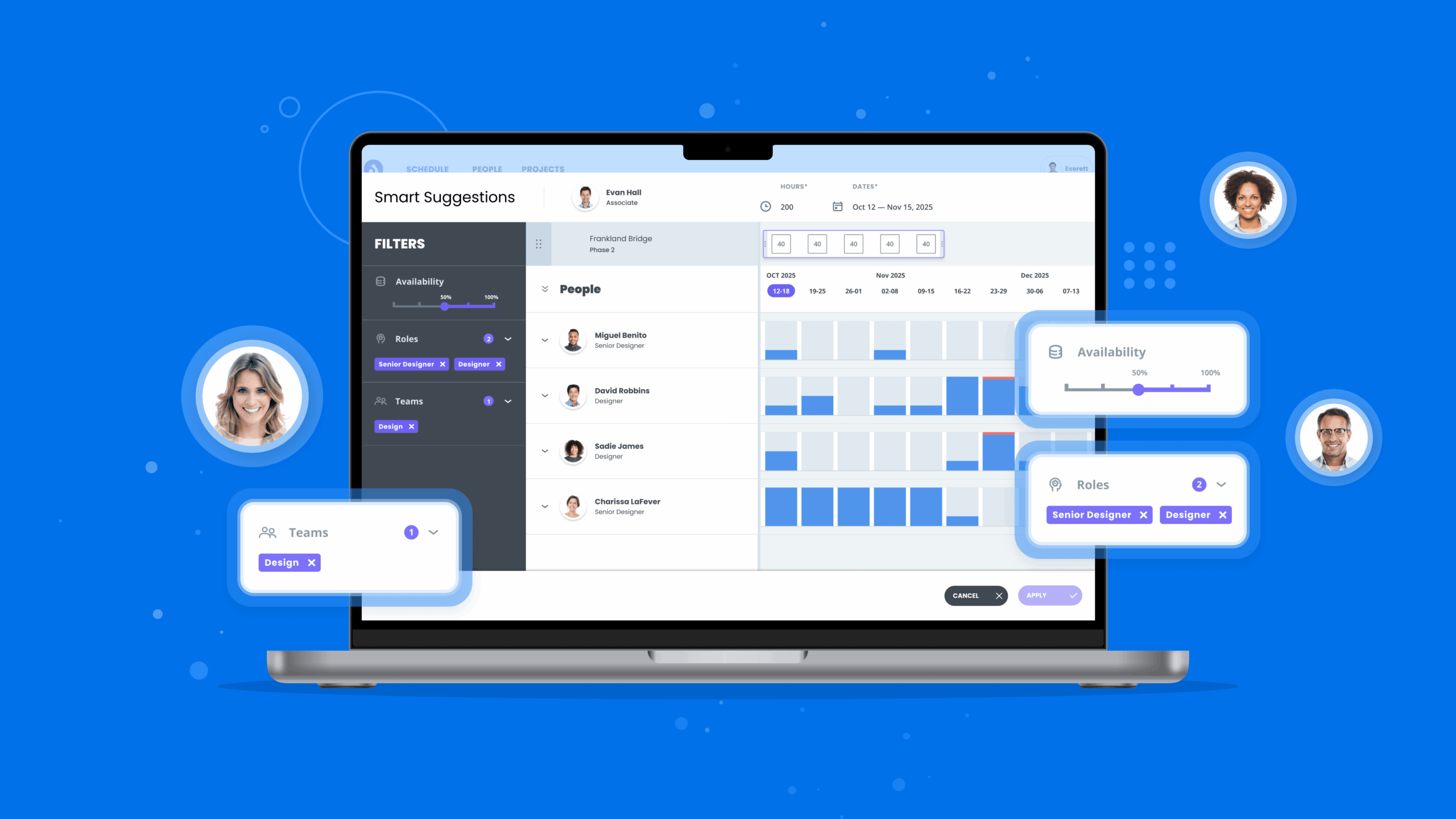

Properly managing your vendor payments is an integral part of the procure to pay process in an AEC firm. This process has a direct impact on cash management and working capital needs because you have to record both the price your firm is required to pay for goods and services and how quickly your vendors need to be paid.

The initial part of procure to pay is recognizing a need for goods and services – which can come from different areas. For instance, you may need a subcontractor to perform work on a task, or you may have hired a new Controller that needs a laptop. Once you recognize demand, then the next step is to think about how to meet that demand.

You may not always need to purchase goods and services to meet demand if you have the resources internally (e.g. you provide the new Controller with a laptop your firm already has). But for the times where you do need to buy, the next step is to place a purchase order with a vendor (assuming you already know the vendor you want to use and the price you must pay them). Here’s why purchase orders are an important next step:

- It sets out the agreed terms for the purchase

- It’s a pre-approval for the purchase and helps eliminate surprises when the vendor’s invoice arrives

- It records the commitment and helps provide a true picture of project profitability

- The vendor’s invoice can be validated against the purchase order to ensure the correct quantity and price have been charged

The bottom line is, purchase orders are a great way to cover your bases when it comes to knowing the commitment to your vendors.

Traditionally, when it came time for payment, vendors were paid via checks. And while this is still an approach for many firms today in the United States, it is now becoming more common to use Electronic Fund Transfers (EFT). EFT has become a more secure form of payment with its improved fraud controls and ability to reduce costs for your firm.

Now that you have a procure to pay process in place, how do you communicate your firm’s performance in being able to manage vendor payments to your executive team? A good place to start is by calculating the Days Payable Outstanding (DPO) ratio. This simple ratio compares your accounts payable balance to your daily purchases and shows the average number of days it takes to pay your vendors.

For example, if current terms with your vendors are to pay them in 30 days, and in doing the DPO calculation you find your average payment time is 25 days, this presents an opportunity for you. You’ll want to analyze this value and find a way to get the payment time closer to 30 days, which allows you to keep that cash within your firm for longer.

So, be sure to focus on these two items in the procure to pay process:

- Strive for a good DPO ratio so it shows your executive team that you’re effectively managing your vendor payments

- Properly document the purchase process. This not only ensures you’re tracking all actual and committed costs on a project, but it also helps you avoid unexpected expenses that can impact your company’s bottom line – making your executive team very happy

Electronic Fund Transfers (EFT)

A payment method where a company pays their vendor by electronically instructing their bank to transfer money to the vendor’s bank account without the need of a check or paper money changing hands.

Days Payable Outstanding (DPO) Ratio

[Accounts Payable / (Cost of Goods and Services / 365 Days)]

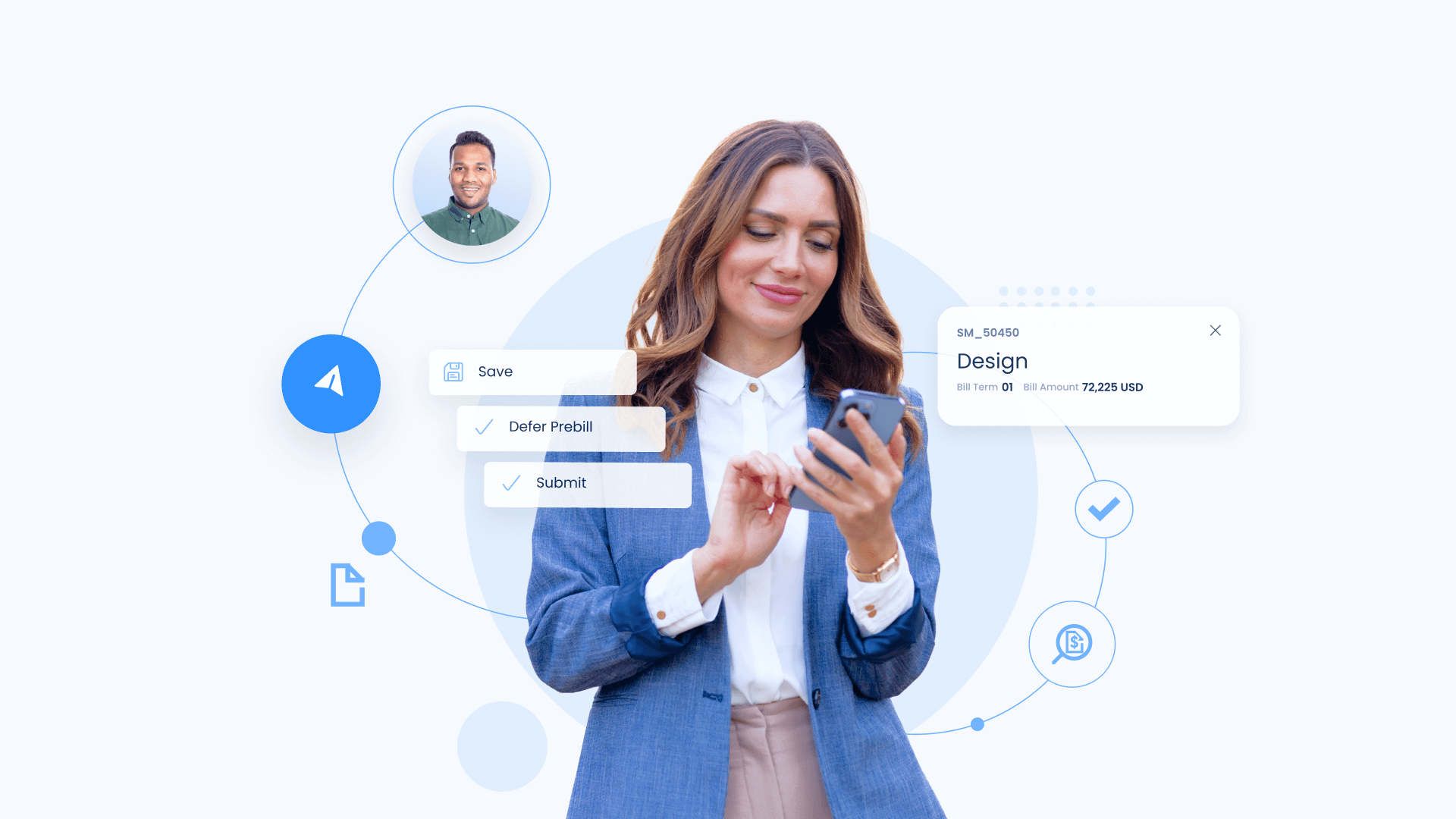

Billing Process

Finally, you have billing. Billing is an important process for all companies, because performance in this area has a direct correlation with how soon your firm can bring money in for the work performed. This process is generally more comprehensive for the AEC industry than it is for others, as the format of an invoice and its contents may vary based on the type of contract or a client’s requirements.

For most AEC firms, this requires invoices to be reviewed for accuracy by someone directly involved in the project (typically, this will be your Project Manager) before an invoice can be submitted to the client. That’s what the draft invoice, often called a prebill, is used for.

As an Accounting Manager, this review process is helpful to you for three distinct reasons:

- You can ensure charges on a project are valid and charged to the proper task

- You can ensure the price is at the rate or markup agreed upon with your client

- You can ensure contract terms, payment terms, and client information is accurate

For some projects, having the invoice is not enough – you need to attach documents to validate the charges on the invoice. This validating documentation is commonly referred to as billing, or invoice, backup and can include: expense receipts, vendor invoices, and signed timesheets.

In some cases, clients may withhold payment until this backup information is delivered – potentially causing major payment delays. To prevent this, you’ll want to consistently provide timely and accurate backup information when billing.

To communicate the effectiveness of your collection process to your executive team, it’s best to calculate the Days Sales Outstanding (DSO) ratio. This measures your firm’s effectiveness in managing outstanding receivables. In producing correct and complete invoices, along with providing the required billing backup, this will help you remove barriers in your collection process and will have a positive impact on your DSO.

What it comes down to, is understanding all the nuances of the billing process to help you make it as efficient as possible. The faster you can collect money for the work being done, the better your cash flow will be. Sounds pretty intuitive right? It is – but it takes discipline, and some serious effort to get this process to be the lean money collecting machine you, and your executive team, want it to be.

Prebill

A draft invoice used to verify validity of transactions prior to submitting an invoice to a client.

Days Sales Outstanding (DSO) Ratio

(Accounts Receivable / Earned Value) X Number of Days

Conclusion

From cash management to the billing process, you need to understand how all these processes work, so you can relay relevant information to your firm’s decision makers. But don’t forget: your communication goes well beyond that. You also need to communicate critical information to the project accounting and project management roles in your firm.

And because accounting, project accounting, and project management roles work together so closely, it’s important for each role to have a fundamental understanding of what the other roles do to contribute to the success of an AEC firm.

That’s why we created The Ultimate ERP Glossary for AEC Firms. Loaded with the latest AEC industry jargon – 150 terms to be exact – not only will you see a whole host of terms related to Accounting Managers, but also to your peers. This will help you better understand your firm as a whole, as this tool spans the standard workflow of the entire project lifecycle.

Click the link below to get your free copy today!