Predict Project Outcomes With BST Insights

Explore

Insights

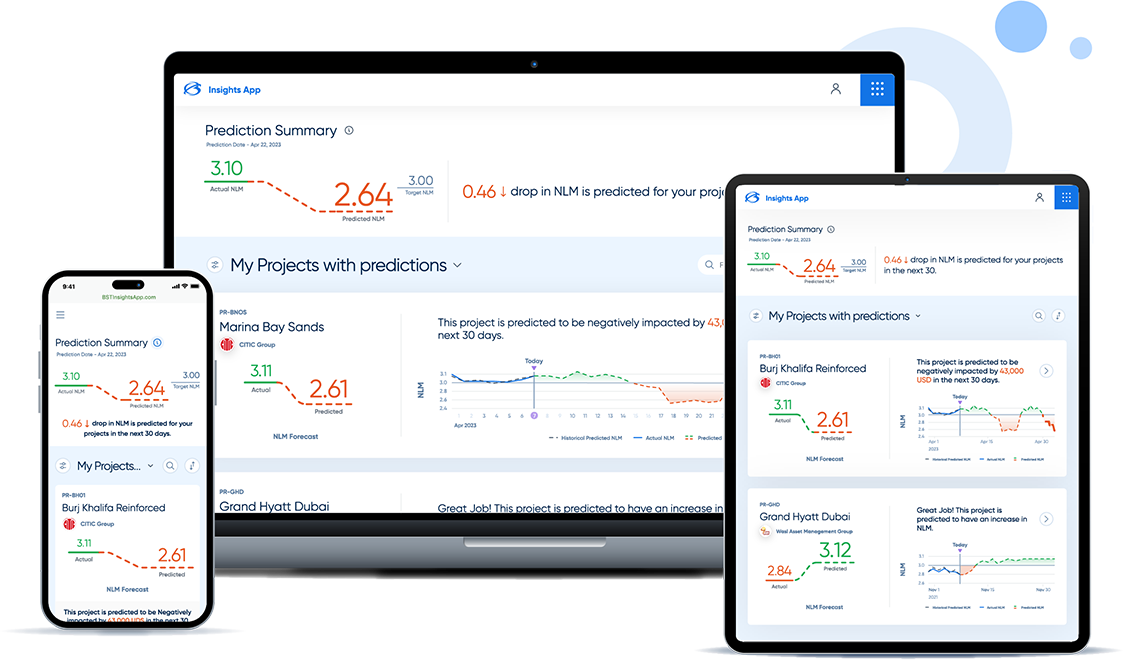

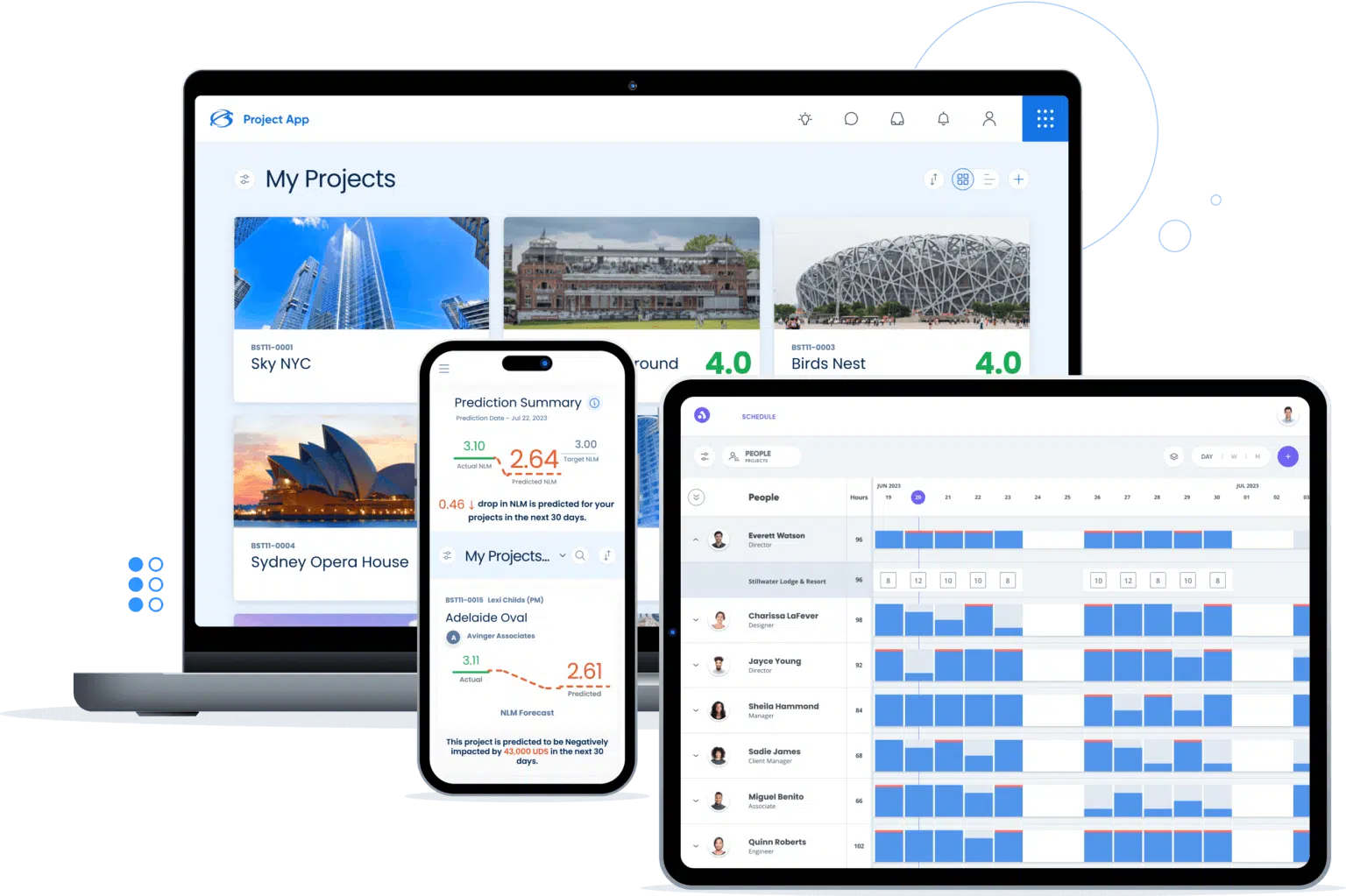

Like Waze GPS, but for projects, BST Insights tracks 35+ digital signals and applies AI and machine learning to predict project outcomes with more than 95% accuracy. This lets project managers at AEC firms easily understand which factors are influencing their projects, and course-correct to positively impact profitability.

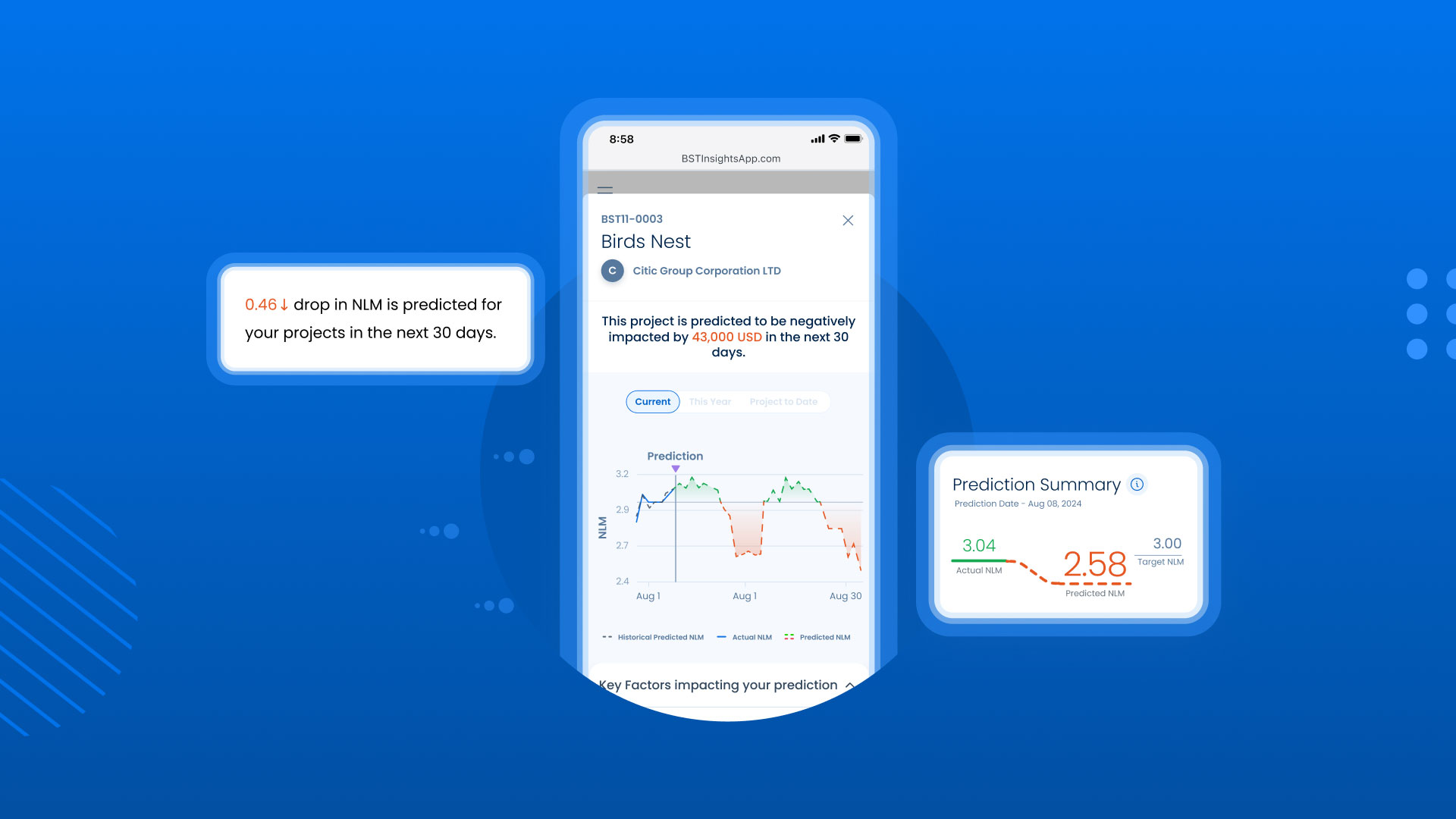

No More Noise

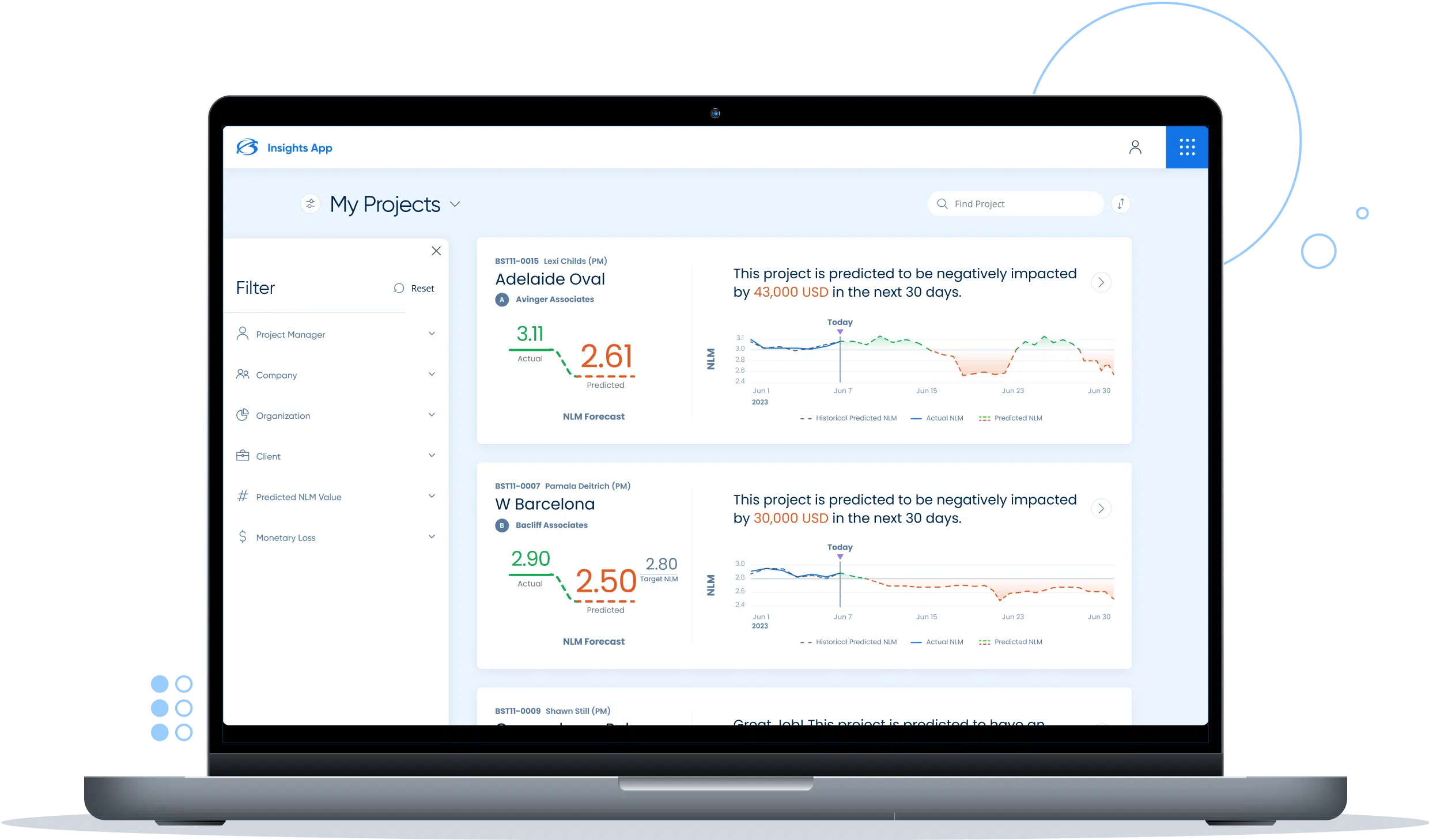

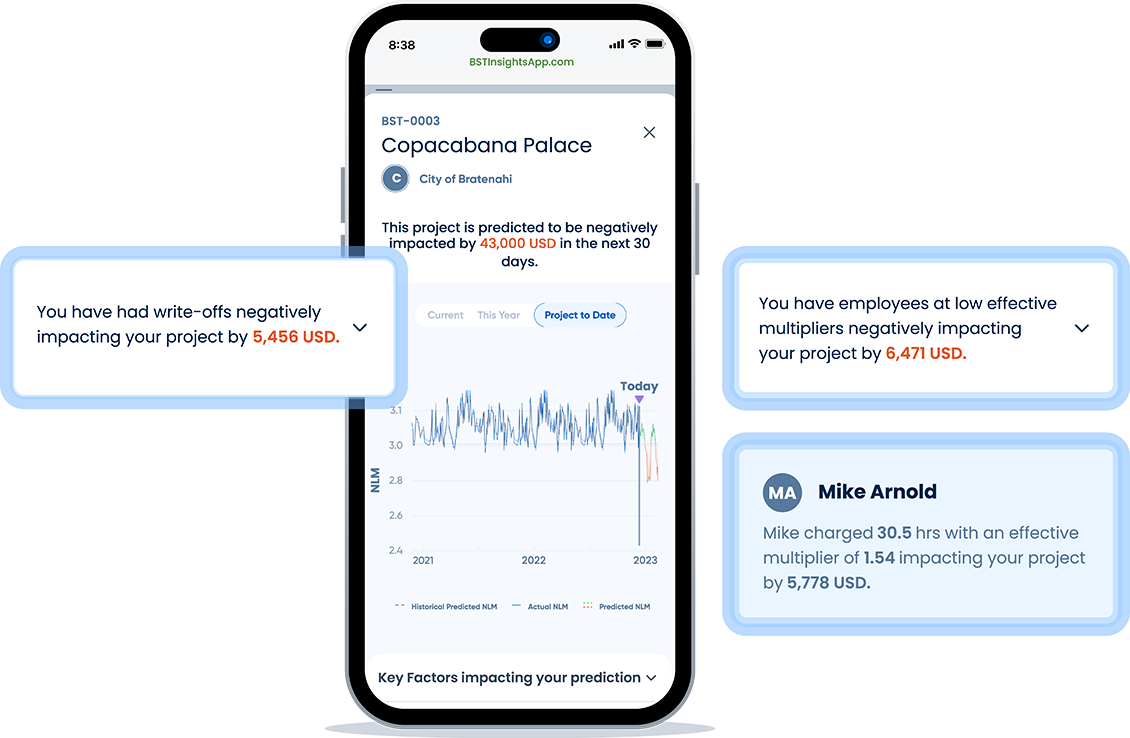

Focusing on net labor multiplier (NLM) as a leading indicator, BST Insights cuts through the data noise so you know exactly what’s impacting project health. Plus, you have the flexibility to adjust target NLM from one project to the next.

Start Your Data Engines

BST Insights’ AI and machine learning capabilities provide anomaly detection, indicate key impact factors, and offer recommendations for how to optimize and get your projects back on track.

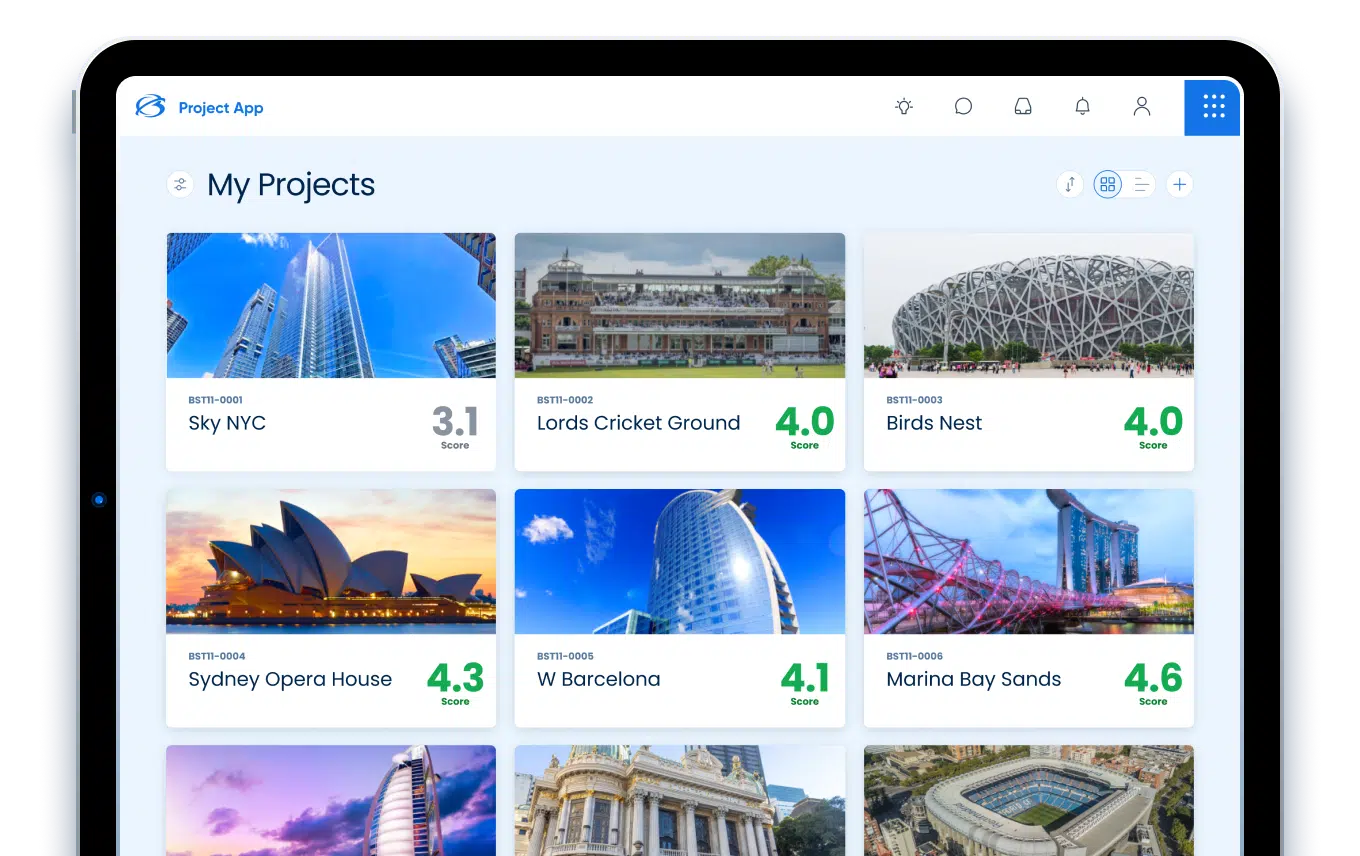

Laser Focused

BST Insights keeps the project’s most urgent needs front and center. It also gives project and operations managers a clear view of their entire portfolio, so they can easily identify which projects need their attention most.

Deployment Details

Here’s what AEC firms can expect as you begin your BST Insights journey.

01

System Setup

BST Global sets up a big-data cloud environment and the client installs a data transporter component.

02

Data Extraction

BST Global uses the data transporter to securely transfer, store and manage data in a data lake.

03

Configuration

The client adds users and roles, sets up NLM thresholds and establishes a schedule for when to run the ML models.

04

Superior Support

BST Global provides professional, responsive, in-house support every step of the way.

Hear From Our Clients

Driving the AEC Industry Forward

Discover Our Other Offerings

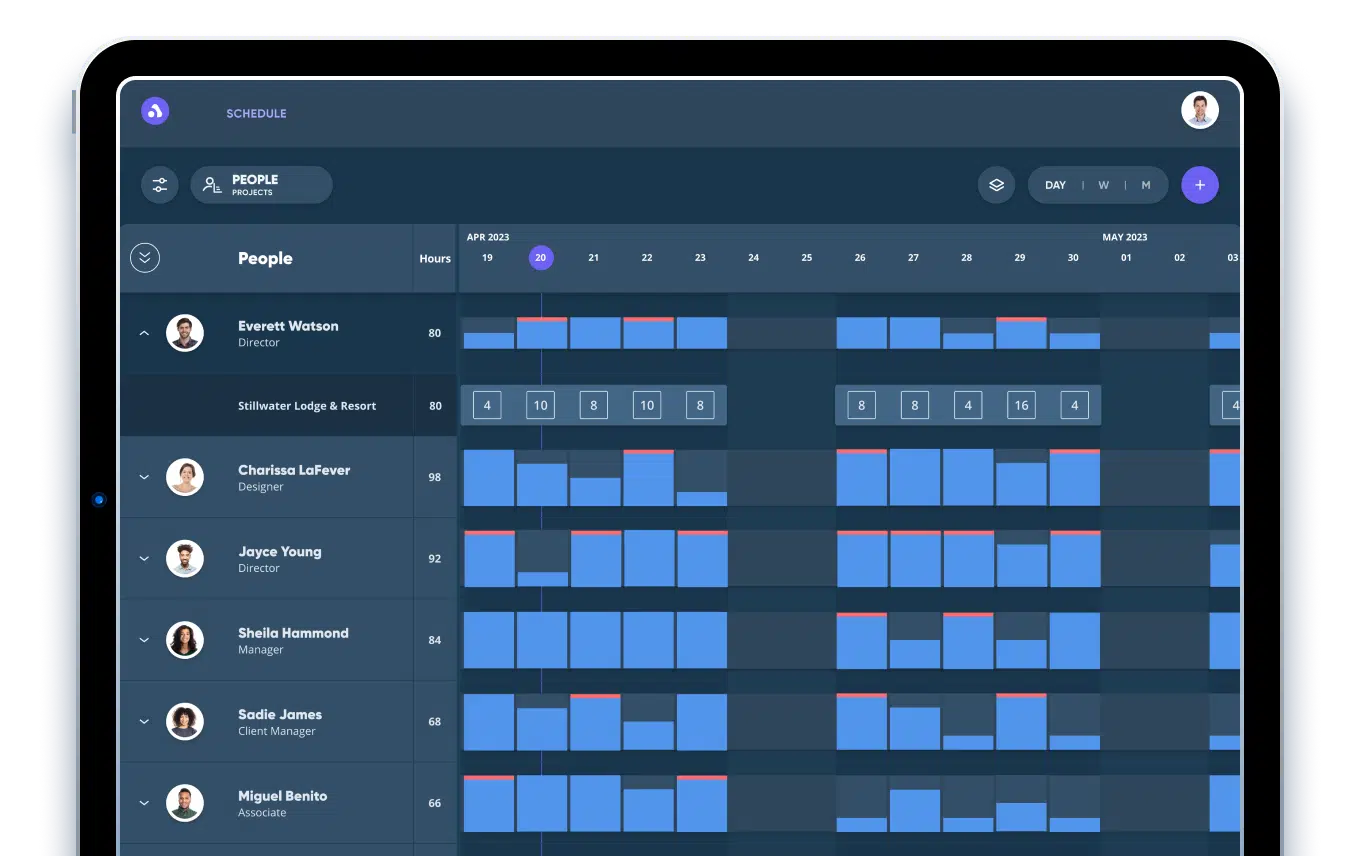

Resource Management

powered by Audere

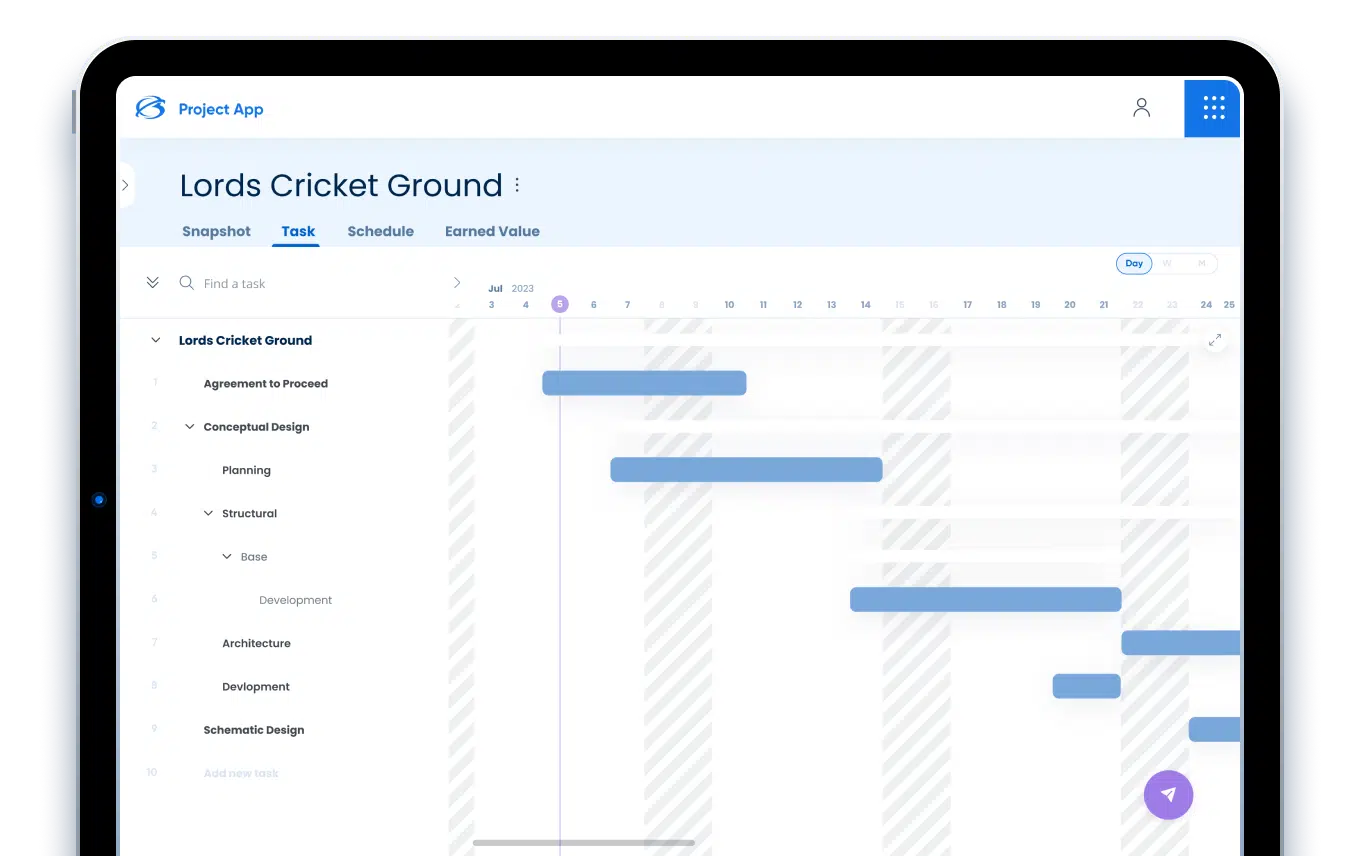

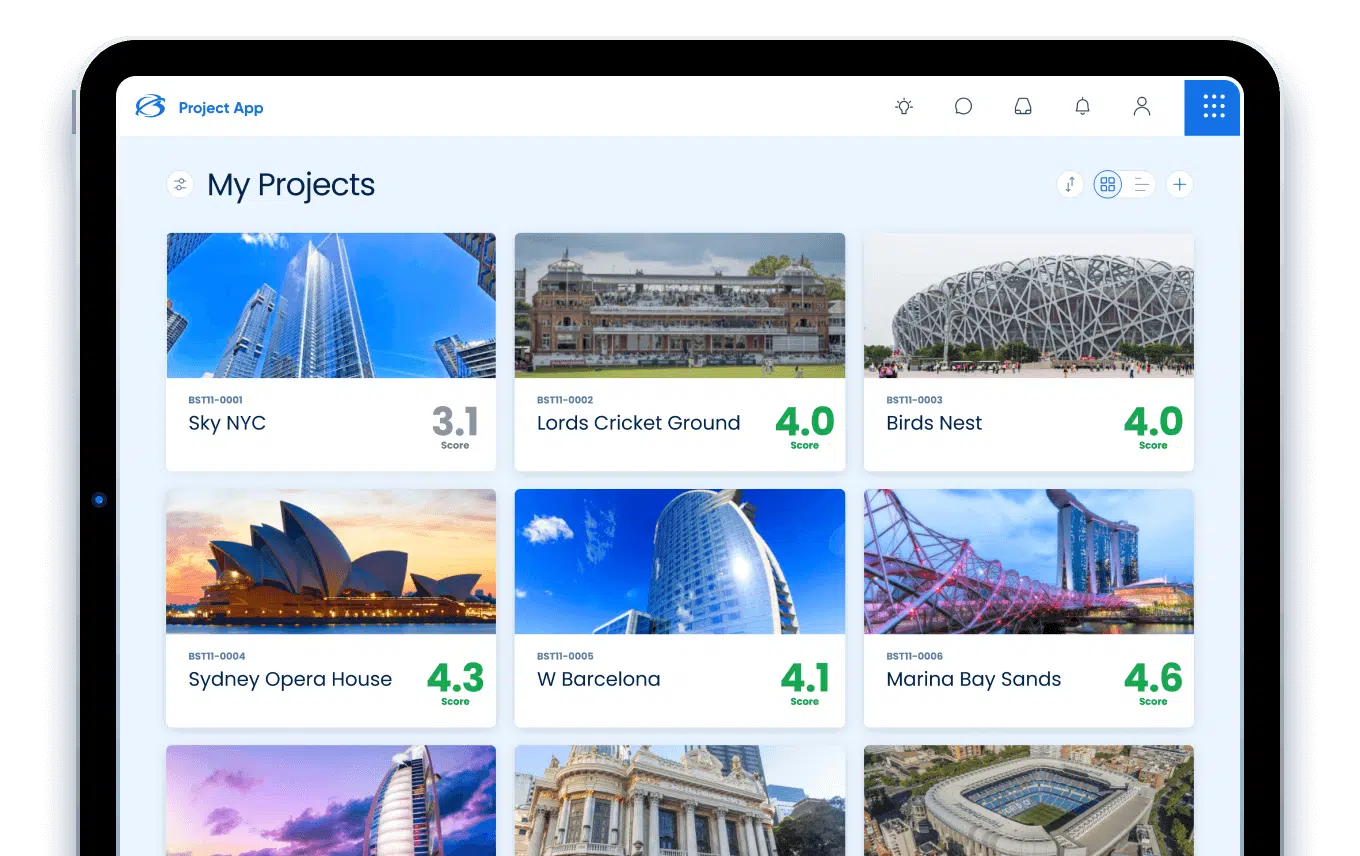

BST11 Work Management

BST11 ERP